How to avoid paying customs duty and VAT when storing imported goods

Interview: Klaus Kalsmose

BDO

Customs warehouse - Get the expert's tips

Have you tried importing goods that are subject to large amounts of customs duties as soon as they land in Denmark? It is a shame if you anyway intend to resell them to a third country (a country that is not a member of the EU). Therefore, it is worth considering the procedure that the Customs Agency calls “customs warehouse”.

We have all the knowledge you need about customs warehousing. We have spoken to a customs expert, Klaus Kalsmose Jakobsen, from the consulting and auditing company BDO. Klaus advises companies on customs duties and VAT.

About BDO

BDO is one of Denmark’s largest consulting and auditing companies. They specialize in auditing and accounting, as well as advice on VAT, customs and taxes. They help a large number of industries and companies with advice and handling of the mentioned points.

BDO’s customs advice helps increase quality and minimize risks with customs processing. They provide qualified and independent customs assistance, from customs declarations to customs advice and customs training. They can also help with the company’s internal customs department, where they guide and develop procedures and processes for cost-effective customs processing, based on applicable laws and regulations.

BDO has many experts who work in different fields. Klaus Kalsmose Jakobsen is head of the Customs and International Trade Department, which is why he is the perfect expert to ask for advice when the subject is customs warehousing.

What is a customs warehouse?

A customs warehouse is the name for a specific area which is approved by the Customs Agency for the storage of goods. It can be a single room, a building, or an outdoor area. It is simply important to ensure that the Customs Agency can carry out controls when they find it necessary. Goods stored under customs warehouse are exempt from customs duty, VAT and taxes. An example is:

- If the imported goods are stored until they are to be resold within the EU, duty and VAT must first be paid when the goods leave the customs warehouse.

This means that you as a company can completely avoid paying customs duties and VAT if you intend to export the goods to a country outside the EU. However, it is not a process that you just access when you feel like. It requires an approval from the Customs Agency, which must be granted to the party that wishes to store the goods. There are two types of permits for customs warehousing:

An importing company can obtain permission to store goods in its private warehouse. However, it requires a number of rules to be respected. The rules are as follows (as described by BDO):

- An accurate account of the goods in the customs warehouse should be kept

- Goods with EU status (that is, goods which have been extracted, harvested or produced in the EU, or imported goods on which duties and taxes have already been paid) must be either physically or in the accounting kept separate from goods which do not have EU status

- Goods in the customs warehouse must not be processed while they are in the warehouse (unless it is a matter of usual processing that serves to ensure the preservation of the goods or to improve their appearance or trading quality - or if it is a question of preparation for distribution or resale), unless the company has permission for processing

- Security must be provided for the customs debt

- The premises must be approved by the Customs Agency

- The Customs Agency must have access to check goods and accounts

You can also find an external company that already has a license for customs warehousing.

This way you get your goods stored without applying for a license from the Customs Agency. However, it is still your responsibility to ensure that your goods in the customs warehouse are not removed improperly and that the rules for customs warehouse are followed.

In addition, you must give the authorized company access to information about which goods (type, package and quantity) you have stored in the customs warehouse.

You must also present customs declarations on transfer to/ removal from customs warehouses. This gives the licensee the opportunity to register the arrival and departure of goods from the storage facilities. (A customs declaration must always be submitted to the Customs Agency when you wish to supply and move goods to/from a customs warehouse).

However, it is certainly also convenient to have a license to store goods in your own customs warehouse. This requires though a more extensive application and approval process.

If you need to process the goods imported from a third country, a different type of authorization is required. In addition to a permit for customs warehousing, it requires a permit for active processing (explanation follows later).

Antidumping tax

When goods are imported into the EU from a third country, anti-dumping duties may be imposed. This happens if the goods are imported at a price that is significantly lower than the selling price in the relevant EU country. Anti-dumping can also be imposed if the state in the exporting country has provided a direct or indirect grant for manufacture, production, export or transport.

The goods can be sold/exported cheaper from the third country if grants have been given for e.g. manufacturing, and this will affect internal competition in the EU.

Example: If a EU company can buy a specific product very cheap from a third country, there will be no incentive to buy the same product from a EU producer.

The product would be much more expensive from the EU manufacturer. The European producers will therefore be forced to lower the prices of their goods to match those of third countries. It will of course be harmful to the economy of EU companies.

Dumping can thus be described as a competition-distorting sale of goods that will harm European producers. Therefore, antidumping duties are imposed on cheap goods from third countries.

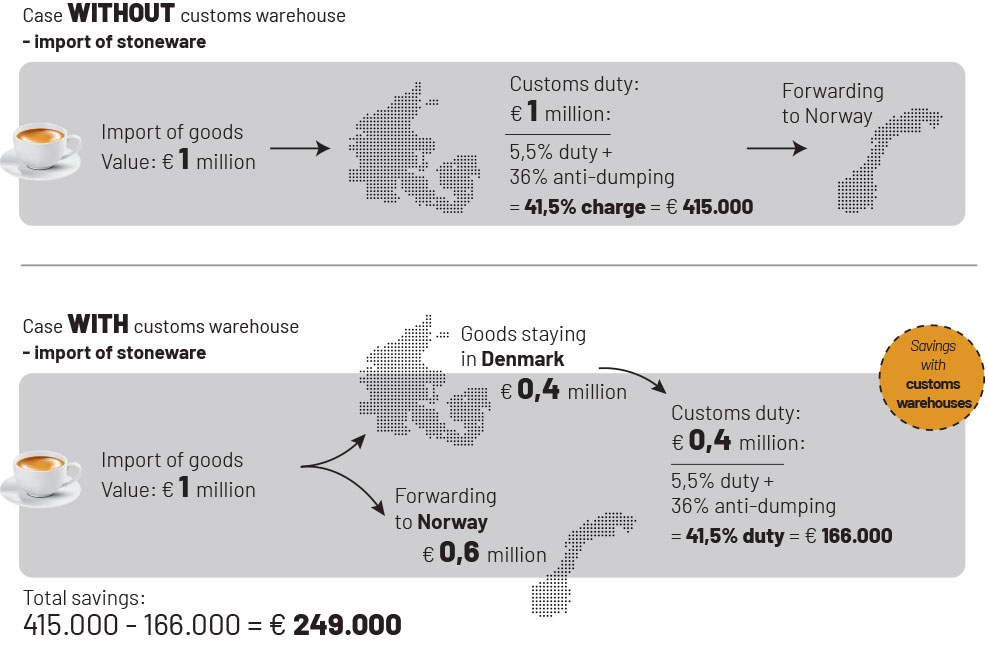

Let’s imagine that a Danish company imports stoneware mugs and plates for DKK 4 million. There is perhaps a 5,5% duty on the stoneware and 36% in anti-dumping. It then amounts to 41,5% in total duty.

1,5 million of the imported goods must be resold in Denmark. Therefore, the company cannot avoid paying duty and VAT on this share of the import. However, they can still store the goods in the customs warehouse. In addition, duty and VAT on the 1,5 million must first be paid when the goods are resold.

The last 2,5 million must be resold to Norway (which is not a member of the EU). They can therefore be imported into Denmark duty and VAT free. This means that you avoid paying 41,5% in customs duty. This corresponds to a saving of DKK 1.037.500.

It is true that customs must still be paid in Norway, but the Danish customs duty of 41,5% is avoided in this situation by using a customs warehouse.

>>

Inward and outward processing

Inward processing

You can avoid paying customs duties and VAT when goods are imported from a third country (a country outside the EU) for processing, repair or any other type of treatment, before they are passed on to another country. It requires the “inward processing” procedure.

For inward processing, the same rules apply as for customs warehousing. Duty and VAT must only be paid when the goods are resold to another EU country. When you have a license for inward processing, you do not have to pay customs duty and VAT if the goods are processed in Denmark and exported to a country outside the EU. If the goods are sold in Denmark/EU, duty and VAT must only be paid on the added value of the imported goods

Outward processing

Outward processing gives a company the right to export goods to a third country to have them repaired or processed. When they have been processed, they are reintroduced in Denmark. This entire process can also be made duty- and VAT-free if you have a licence.

Public: The public customs warehouse allows an authorized company to operate a warehouse for both itself and other companies. This requires an agreement between the companies. The two parties share responsibility for ensuring that the right rules are followed.

Private: In this situation, it is only the authorized (licensed) company that is responsible for the delivered goods. The private customs warehouse is typically used by companies that need permission to store their own goods in their customs warehouse.

Other companies can also store in a company’s private customs warehouse. However, this requires an agreement, and this is done solely on the licensee’s responsibility.

Example of active processing:

If a Danish furniture manufacturer is offered to sell its furniture in the USA, it could be an excellent business opportunity. It gives access to a market much larger than the Danish one.

However, the American furniture business requires that the furniture is made in American wood. The wood must be imported to Denmark before the furniture can be manufactured. Now suddenly customs and VAT must be paid on the imported materials. The business opportunity therefore does not appear as advantageous as first expected. This is where inward processing comes into discussion. It is actually worth to import the wood – you just need a license to process the imported goods.

With a grant for inward processing, the Danish furniture manufacturer can definitely import the American wood and transform it into furniture. Subsequently, it can be re-exported to the USA – completely duty and VAT free. It can therefore still be good business for the Danish company. They are allowed to import and export goods duty-free.

It is a procedure that is worth keeping in mind if you work with production or imports. It can open the doors to several agreements that would otherwise not be worth it

>>

The benefits of customs warehousing – is it relevant for your company?

There are quite a few benefits for using a customs warehouse when you import goods to Denmark. The biggest and most obvious benefit is that you can avoid paying duty and VAT on your goods. Some companies import large quantities of goods and others import goods with high tariffs. The customs warehouse is therefore a very advantageous solution.

There can also be a benefit for the companies that resell the goods within the EU. They must of course pay duty and VAT when the goods are sold. However, the key word is “when”. In the case of customs warehousing, no duty or VAT is paid when the goods are imported into Denmark, nor while the goods are standing still in the warehouse.

Customs duty and VAT must only be paid when the goods are removed from the customs warehouse. This gives the company a great deal of freedom in deciding when the customs and VAT charges must be paid.

The benefits of the customs warehouse are easy to see. It can also easily be a good addition to your import processes. However, it is difficult to mention the positive aspects without mentioning the challenges. There are undeniably a few considerations to make before deciding to pursue this possibility.

What should you be aware of when using customs warehouse?

If you are considering using the procedures for customs warehousing or inward processing, there is one factor in particular that should be mentioned as challenging – namely the time consumption.

It is a longer process to get a grant for one of the two procedures. Even if the company is authorized, it requires a large amount of extra work while the goods are stored. Thorough accounts of the stored goods must be kept, storage facilities will be costly, the Customs Agency must be constantly updated, etc.

A lot of time will be spent on the process, regardless of whether you use private or public customs warehouse. In the end, it all has to be compared to the savings expected to be achieved from the reduced customs and VAT.

>>

We can help with that

Traid helps you ensure that declarations and documentation to the Danish Customs Authority are handled as easily as possible. All your import and export documents can also be created digitally on our platform – easy and fast. You can use the platform to create digital certificates of origin, food certificates, customs documents and much more. This way, you save both time and money – and at the same time you minimize the number of manual processes and the occurrence of typing errors.

Our capable partners at BDO are specialized in customs, VAT and tax. They are ready to guide you when you have questions about the customs processes, and they help you get started with e.g. customs warehousing and inward/outward processing.

Read more about the Traid platform here, and visit BDO’s website, where you can read more about the rules for customs, VAT and tax.

Share article

See all the benefits

News that might interest you

e-Export is closing: If you want to export after September 1st, get started now!

e-Export will close on September 1st this year. If you are not prepared for how to handle your customs and export registrations, you will not be able to export your goods after this date.

IT solution to manage your ATA Carnets

We offer an affordable IT-solution to manage and issue your ATA Carnets.

Our solution offers a complete workflow and life-cycle management for ATA Carnets for both chamers of commerce and exporting businesses.

Follow the development of DIX – the Danish Veterinary and Food Administration’s

Follow the development of DIX – the Danish Veterinary and Food Administration’s digital food certificates Morten Jensen Øllgaard Cofounder & CEO On this page, we

KNOWLEDGE

GET INSPIRATION IN YOUR INBOX

Knowledge

Get tips straight in your inbox

Get inspired and find out how you can streamline your export processes and logistics

Reach out – we’re ready to help:

Phone: +45 53 50 35 90 | info@clearviewtrade.com

Platform

Get tips straight in your inbox

Get inspired and find out how you can streamline your export processes and logistics

Reach out – we’re ready to help:

Phone: +45 53 50 35 90 | info@clearviewtrade.com