DMS Export:

How to avoid paying customs duties when working with inward processing?

Are you looking for a powerful tool to support inward processing? Then we can help you with our easy-to-use export platform. As part of our DMS update, you will also be able to work with inward processing.

We work with some of the country’s largest exporters – Dansk Erhverv, Dansk Industri and others – where we provide the workflow solutions that digitise and automate export processes – including inward processing.

When working with inward processing, you can either choose an ERP integration or use our online goods catalogue to register the goods you assign to inward processing.

In combination with our integration to DMS (the new customs system), this gives you control and traceability throughout the entire process:

- Re-export from the EU customs territory

- Release revenue

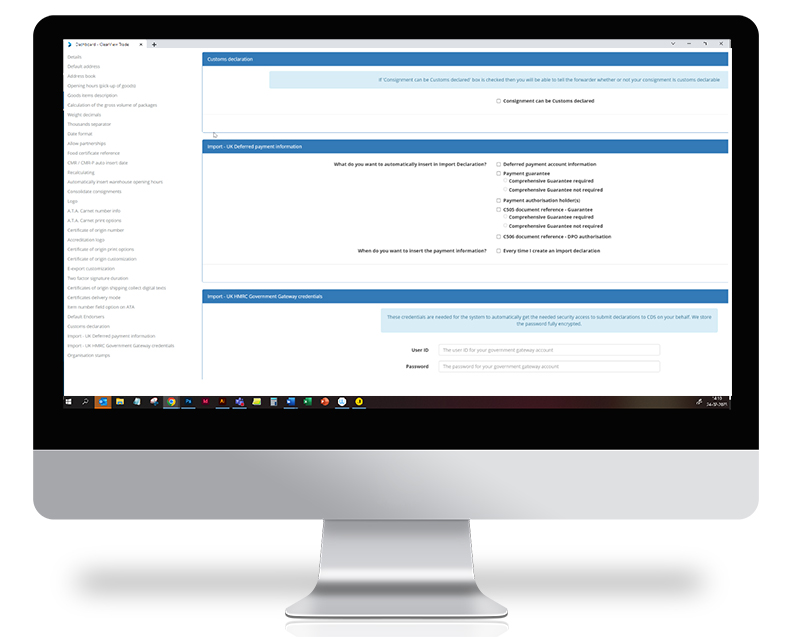

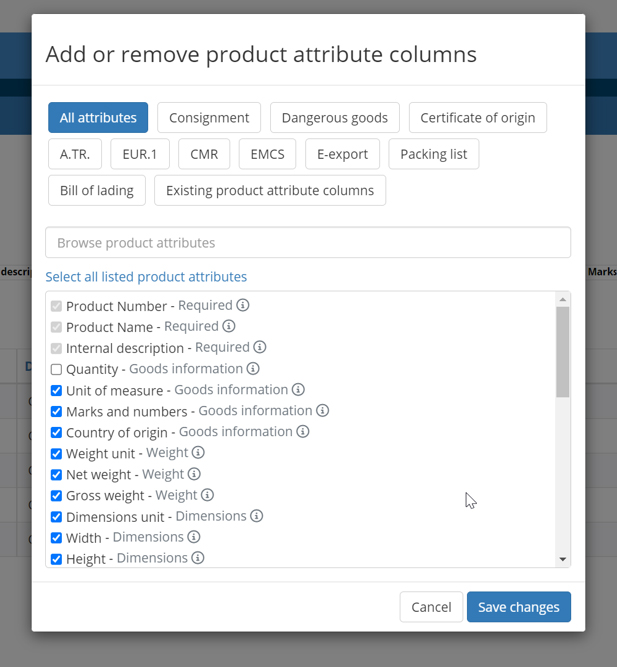

Customise, configure and digitize

You customise, configure and digitise your customs workflows in our platform. With our export platform, you digitise the processes around inward processing along with the rest of your export documents and processes:

- Customs exports

- EMCS

- Certificates of Origin, EUR1, AT.R., CMR, food certificates, etc.

Transport bookings (sea, air, road…) - Document sharing and library

On our platform, you can configure and customise your workflow, set up catalogues and more for a streamlined workflow.

Who is inward processing relevant to?

Inward processing is relevant for companies that have production in the EU and import raw materials and semi-finished products from outside the EU that are used in production:

- If you re-export the finished product, i.e. the product in which the imported raw materials and semi-finished products are incorporated, to countries outside the EU

- If the finished product/finished product has a lower tariff rate than the imported raw materials and semi-finished products

Who is inward processing relevant for?

Inward processing is relevant for companies that have production in the EU and import raw materials and semi-finished products from outside the EU to be used in their production:

- If you re-export the finished product, i.e. the product in which the imported raw materials and semi-finished products are incorporated, to countries outside the EU

- If the finished product/finished product has a lower tariff rate than the imported raw materials and semi-finished products

Why should you use inward processing?

As a manufacturer, you may be able to save money by using a lower tariff. You can reduce your capital tied up and improve your cash flow when working with inward processing:

- You save money by avoiding double customs clearance when importing and subsequently re-exporting to countries outside the EU

- You may be able to get a lower duty rate within the EU if the processed end product has a lower duty rate than the imported raw materials

- You defer your payment of customs duties until the goods are sold to countries within the EU

If a Danish furniture manufacturer is offered the opportunity to sell its furniture in the US, it could be an excellent business opportunity.

It provides access to a market that is much larger than the Danish one. However, the American furniture store requires that the furniture is made from American wood.

The wood must be imported to Denmark before the furniture can be manufactured. Now, suddenly, customs duty and VAT must be paid on the imported materials. The business opportunity is therefore not as lucrative as initially expected. This is where inward processing comes in. Importing the wood is actually quite profitable – you just need a licence to process the imported goods.

With an inward processing licence, the Danish furniture manufacturer can safely import the American wood and turn it into furniture. It can then be re-exported to the US – completely duty and VAT free. This can still be a good business opportunity for the Danish company. They are allowed to import and export goods duty-free.

It’s a procedure worth keeping in mind if you’re involved in manufacturing or importing. It can open the doors to a number of deals that would otherwise not be worthwhile.

(Thanks to the Danish Customs Agency for the inspiration for the example)

Are you new to inward processing?

With inward processing, there is great potential and opportunity to improve your cash flow. However, it requires you to have your processes and documentation in place when working with bonded warehouses. Our export platform can help you with this, but you need to have knowledge of the goods and products you’re working with, such as which customs and HS codes to use.

You must have a suspension or inward processing authorisation. As a rule, the customs authorities must issue a suspension/ inward processing authorisation before or at the latest in connection with the import of the goods placed under the inward processing procedure.

Interested in more?

You can read more about inward processing and its requirements here:

https://info.skat.dk/data.aspx?oid=2230138

https://eur-lex.europa.eu/legal-content/DA/TXT/?qid=1568192349196&uri=CELEX:32013R0952

You must apply for an authorisation via the Customs Authorisation System: https://skat.dk/data.aspx?oid=8845

Få tips fra eksperterne og læs flere historier

Get tips from the experts and read more stories

Read more about customs warehousing, examples and cases in a post we made together with the auditing firm BDO: https://traid.io/dk/toldoplag/

Read the story “Coffee importer received a bill of DKK 27,000 – how to avoid the same situation”:

Get an efficient, stable and flexible export workflow

We are familiar with creating integrations for authorities such as the Danish Customs Agency,

the Danish Veterinary and Food Administration and chambers of commerce.

Naturally, we are also launching an efficient and flexible integration to DMS Export with the possibility of

reuse of data across documents, certificates and transport bookings in the platform.

All Danish exporters will have access to a one-to-many solution.

Kaffeimportør fik regning på DKK 27.000 - Sådan undgår du at stå i samme situation

When coffee beans are shipped from Kenya to Denmark, a number of customs documents must be attached, and these must be filled out correctly.

Rune Sandholt, who runs the coffee company NGUVU, was fined DKK 27,000 because one digit was missing from a long commodity code on a document he didn’t even fill in himself…

Curious about inward processing?

You are welcome to contact us. We’d love to have a dialogue with you about outward processing – and offer suggestions on how to optimise your export workflow. Digitalising processes can save you a lot of time and money.

3.500 glade kunder – et udplug…