DMS Export:

How to avoid paying customs duties when you work with outward processing

Are you looking for an efficient tool to support outward processing? Then we can help you with our easy-to-use export platform.

As part of our DMS update, you’ll also be able to work with outward processing – and avoid paying customs duties.

We work with some of the country’s largest exporters – Dansk Erhverv, Dansk Industri and others – providing workflow solutions that digitise and automate export processes.

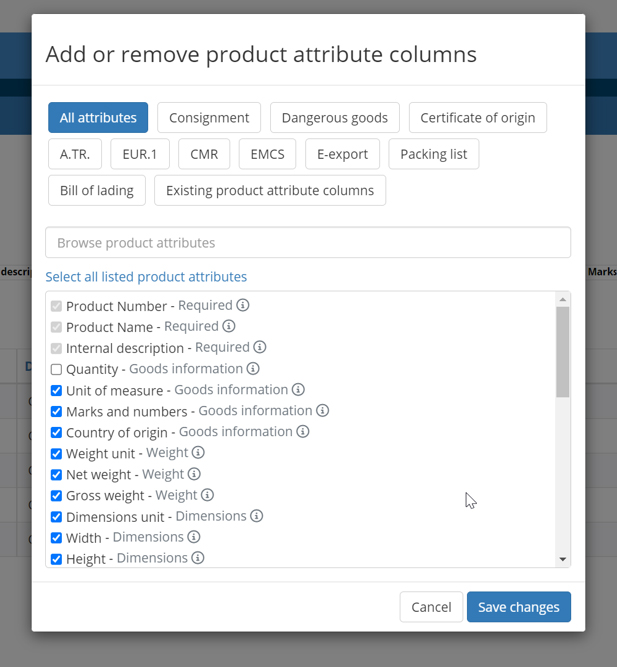

You can either choose an ERP integration, use our online product catalogues to register the goods you export for outward processing or your customs clearances on an on-demand basis.

Get a complete status overview of your exports

You’ll receive regular status notifications and updates on your customs clearances, bookings, etc. With our export platform, you automate your customs processes along with your other export documents and processes:

- Customs exports

- EMCS

- Certificates of Origin, EUR1, AT.R., CMR, food certificates, etc.

- Transport bookings (sea, air, road…)

- Document sharing and library

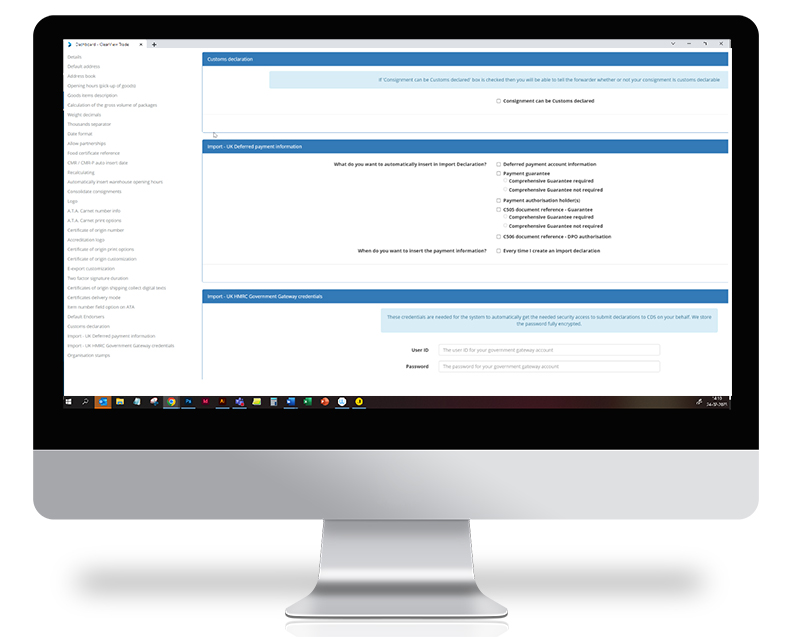

On our platform, you can configure and customise your workflow, set up catalogues and more for a streamlined workflow.

Who is outward processing relevant to?

Outward processing is relevant for companies that need to export temporarily to countries outside the EU and then re-import (re-import) the goods again. With outward processing, you can avoid paying customs duties:

- Processing of EU-produced raw materials outside the EU

- Repairs carried out in countries outside the EU

- Installation, fitting, assembly, etc. of EU-produced components in non-EU countries EU-producerede komponenter i lande udenfor EU

Why should you work with outward processing?

As a business, you can save money by avoiding double customs clearance on re-importation after the goods have been temporarily outside the EU.

Outward processing allows you to export goods to third countries. In the example below, your product – Danish cotton – is exported to the USA for processing (production of t-shirts) and subsequently re-imported into the EU without an increased customs duty.

Generally, the duty is calculated by adding a fictitious duty to the exported product (in this case cotton). The duty payable on the imported/importing t-shirts is deducted.

It is also possible to calculate the duty based on processing costs. Typically, these are goods produced in the Far East.

Other examples:

- Warranty repairs carried out in a third country on goods sold to customers in the EU’

- Assembly, installation and assembly in a third country of EU-produced components

Are you new to outward processing?

You can save money on duties and taxes, but you need to be in control of your processes and documentation when working with outward processing. Our export platform can help you with this, but you need to have knowledge about the goods and products you work with – such as which customs and HS codes to use.

You must have an authorisation for outward processing. As a rule, the customs authorities must issue a suspension/active processing authorisation before or at the latest in connection with the export of the goods placed under the outward processing procedure.

Interested in more?

You can read more about inward processing and its requirements here:

https://info.skat.dk/data.aspx?oid=2230156

https://eur-lex.europa.eu/legal-content/DA/TXT/?qid=1568192349196&uri=CELEX:32013R0952

You must apply for an authorisation via the Customs Authorisation System:

https://skat.dk/data.aspx?oid=8845

Get tips from the experts and read more stories

Read more about customs warehousing, examples and cases here in a post we made together with the accounting firm BDO sammen med revisionsfirmaet BDO:

Read the story ”Coffee importer got a bill for DKK 27,000 – how to avoid the same situation”.

Read also about inward processing

Get an efficient, stable and flexible export workflow

We are familiar with creating integrations for authorities such as the Danish Customs Agency,

the Danish Veterinaryand Food Administration and chambers of commerce.

Naturally, we are also launching an efficient and flexible integration to DMS Export with the possibility of

reuse of data across documents, certificates and transport bookings in the platform.

All Danish exporters will have access to a one-to-many solution.

Coffee importer received a bill for DKK 27,000 - How to avoid the same situation

When coffee beans are shipped from Kenya to Denmark, a number of customs documents must be attached, and these must be filled out correctly.

Rune Sandholt, who runs the coffee company NGUVU, was fined DKK 27,000 because one digit was missing from a long commodity code on a document he didn’t even fill in himself…

Curious about outward processing?

You are welcome to contact us. We’d love to have a dialogue with you about outward processing – and offer suggestions on how to optimise your export workflow. Digitalising processes can save you a lot of time and money.

3,500 happy customers – a selection…